Nuclear for Data Centers: Why the Gen IV SMR Timeline is 2035

- Tony Grayson

- Dec 11, 2025

- 11 min read

Updated: Jan 7

By Tony Grayson, President & GM of Northstar Enterprise + Defense | Built & Exited Top 10 Modular Data Center Company | Former SVP Oracle, AWS & Meta | U.S. Navy Nuclear Submarine Commander | Stockdale Award Recipient

Published: December 11, 2025 | Updated: January 7, 2026 | Verified: January 7, 2026

TL;DR:

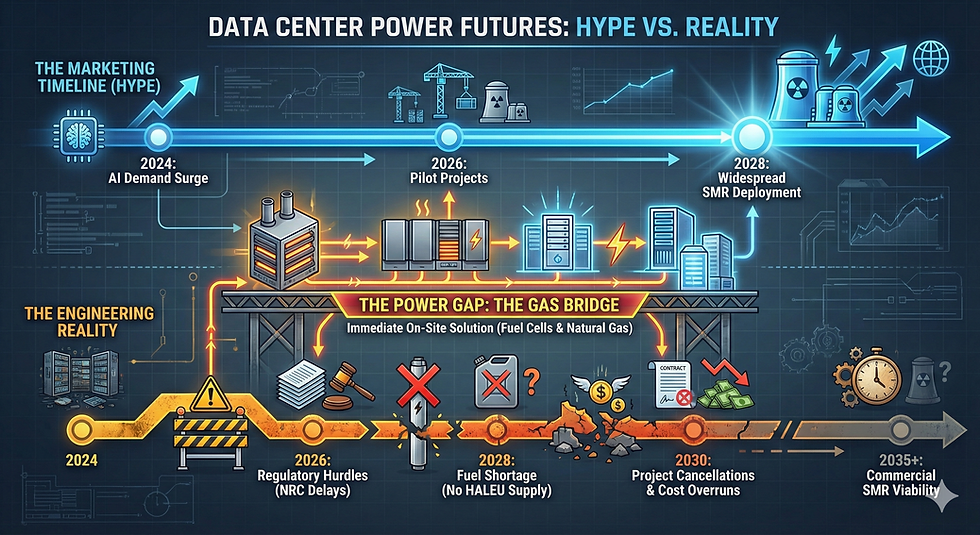

"Nuclear is the only viable long-term solution for AI's insatiable power demands, but the hype timeline is fiction. Gen IV SMRs won't reach commercial scale until 2035+, not 2028. The bottlenecks aren't funding or political will, they're physics. Materials testing for thermal creep requires 10+ years of data. HALEU fuel production needs to scale by 50x to meet current capacity. You cannot "venture capital" your way past thermodynamics. Smart operators are executing a Bridge Strategy: natural gas and grid optimization today, nuclear-ready infrastructure tomorrow." — Tony Grayson, President & GM Northstar Enterprise + Defense

In 30 Seconds:

Data centers will need 945 TWh by 2030—equivalent to Japan's entire electricity consumption. Everyone's betting on SMRs, but here's the reality check: TerraPower broke ground in June 2024, targeting first operation by 2030, with full commercial viability in the mid-2030s. Google's Kairos deal aims for 500MW by 2035. First-of-a-kind SMR costs have exploded to $14,600/kW—five times 2020 projections. The fuel supply chain produces 900 kg/year; we need 50+ metric tons. This isn't pessimism—it's engineering reality. Plan accordingly.

COMMANDER'S INTENT: THE 2035 REALITY

The Mission: Cut through SMR marketing hype and provide the engineering reality of nuclear timelines for data center operators and investors.

The Reality: Gen IV reactors face three immovable constraints: (1) Materials must prove 30-year performance under 700-950°C thermal creep—requiring 10+ years of testing data. (2) HALEU fuel production must scale 50-100x from current capacity. (3) NRC licensing requires physical in-pile validation, not simulations. These aren't bureaucratic hurdles; they're physics.

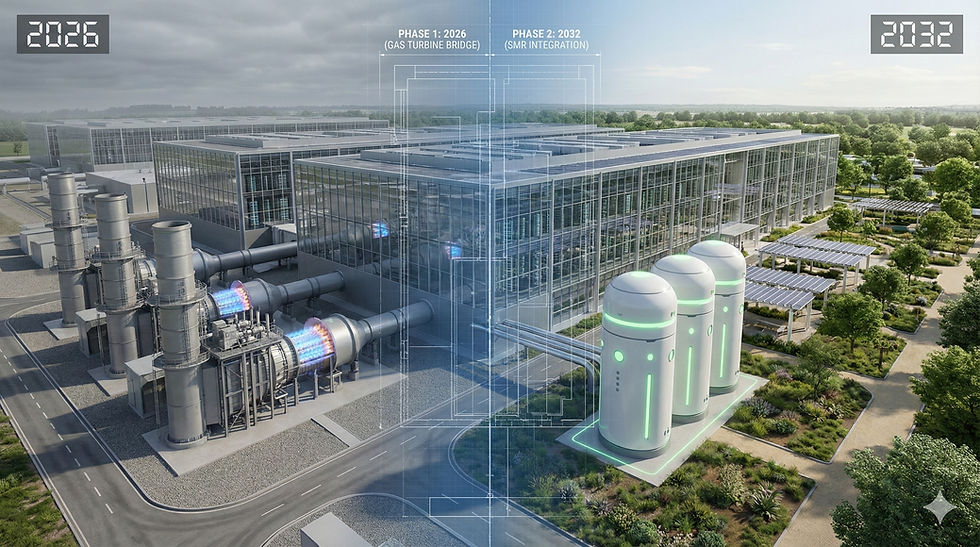

The Tactical Takeaway: Execute the Bridge Strategy. Survive the decade with high-efficiency natural gas, grid optimization, and battery storage. Design infrastructure today (nuclear-rated switchgear, seismic isolation) that's ready to accept SMR power when the reactors are finally ready. "Waiting for nuclear" is not a strategy.

Executive Summary:

The Problem: Nuclear power for data centers is the only viable long-term solution for AI power, but the "2028" hype timeline is unrealistic.

The Bottleneck: It is not just funding; it is physics. Materials testing for thermal creep (ASME code qualification) and the lack of a HALEU fuel supply chain force a realistic SMR timeline of 2035.

The Strategy: Infrastructure leaders must adopt a "Bridge Strategy"—optimizing natural gas and grid efficiency today while building the nuclear-ready infrastructure for tomorrow.

Why is the SMR Timeline Delayed? (The Engineering Reality)

The short answer: The delay in the SMR timeline is driven by materials science, specifically Thermal Creep, and the rigid testing timelines required by the ASME Boiler and Pressure Vessel Code. You cannot "venture capital" your way out of physics.

The "Creep" Cliff

In the tech world, we are used to software timelines where products iterate monthly. In the nuclear world, we are governed by thermodynamics.

The Physics: Standard Light Water Reactors (LWRs) operate at temperatures where steel remains rigid. Gen IV reactors (using molten salt, sodium, or gas) operate at 700°C–950°C. At these temperatures, metal suffers from thermal creep—it stretches under its own stress over time.

The Rule of 3: Under ASME Section III, Division 5, you cannot simply accelerate this testing by raising the temperature, because that changes how the metal fails. To qualify a material for a 30-year life, you need valid test data for roughly 10 years.

Strategic Insight: If a startup claims to have a "novel proprietary alloy" ready for deployment in 2028, be skeptical. Unless they have 100,000 hours of creep-rupture data already in the vault, they are presenting a PowerPoint, not a reactor. This is why pragmatic players like TerraPower are designing their first Natrium reactors with 316 Stainless Steel (a material with 50 years of data) trading performance for certifiability.

Nuclear for Data Centers: The HALEU Supply Chain Bottleneck

The short answer: Most Gen IV designs require High-Assay Low-Enriched Uranium (HALEU), but the U.S. currently has almost zero commercial capacity to produce it. Scaling nuclear for data centers requires a fuel supply chain that does not yet exist.

The Math: 900 kg vs. 50 Metric Tons

The fuel supply chain is the "silent killer" of the 2027 timeline.

The Demand: To support a commercial fleet of SMRs for data centers by the mid-2030s, the U.S. will need an estimated 50+ metric tons of HALEU per year.

The Supply: As of late 2025, the only licensed HALEU production in the U.S. (Centrus Energy’s demonstration cascade) has a capacity of roughly 900 kg/year.

The Gap: We need to scale production by 50x to 100x. This requires building new centrifuge cascades and navigating NRC Category II fuel cycle licensing—a 5 to 7-year capital project before significant volume hits the market.

Can AI Accelerate the SMR Timeline?

The short answer: AI helps with scoping, but it cannot replace in-pile testing for licensure. The NRC requires physical validation of how radiation and stress interact deeply within the material.

The "Ion Beam" Fallacy

We often hear that simulation will solve the materials crisis.

Surface vs. Depth: You can accelerate radiation damage using ion beams (simulating years of damage in hours), but this only damages the top few microns of the material.

The Reality: Neutrons in a reactor penetrate the entire vessel. Relying on ion beam data for structural integrity is like crash-testing a car by scratching the paint. For final licensing, the NRC usually demands in-pile data (actual reactor testing) to prove the simulation matches reality.

When will Nuclear for Data Centers be Ready?

The short answer: Expect demonstration units (prototypes) in the late 2020s, but commercial deployment at the scale required for hyperscalers won't arrive until 2035–2040.

The Bridge Strategy

For data center leaders, this timeline confirms that "waiting for nuclear" is not a strategy. We must execute a Bridge Strategy:

Survive the Decade: Utilize high-efficiency natural gas, grid optimization, and battery storage for the 2025–2035 gap.

Design for the Swap: Build infrastructure today (nuclear-rated switchgear, seismic isolation) that is ready to accept SMR power when the reactors are finally ready for us.

"You cannot 'venture capital' your way past thermodynamics. If a startup claims a 'novel proprietary alloy' ready for 2028, be skeptical—unless they have 100,000 hours of creep-rupture data in the vault, they're presenting a PowerPoint, not a reactor."

— Tony Grayson, former U.S. Navy Nuclear Submarine Commander

Frequently Asked Questions: Nuclear SMRs for Data Centers

When will SMRs like TerraPower Natrium actually be ready for data centers?

TerraPower's Natrium reactor broke ground in June 2024 in Kemmerer, Wyoming—the first commercial advanced reactor construction in the United States. While marketing materials suggest 2028-2030, realistic timelines point to 2030 for initial operation with full commercial viability in the mid-2030s. The $4 billion project backed by DOE and Bill Gates must overcome HALEU fuel bottlenecks that have already pushed timelines from the original 2028 target. Google's Kairos Power deal targets the first reactor by 2030 with full 500MW deployment by 2035.

What is HALEU, and why is it delaying SMR deployment?

HALEU (High-Assay Low-Enriched Uranium) is enriched between 5-20% U-235, compared to 3-5% for conventional reactor fuel. Most advanced SMR designs require HALEU for smaller designs, longer operating cycles, and increased efficiency. The critical problem: HALEU is not currently available from domestic suppliers. The DOE estimates demand could reach 50 metric tons per year by 2035 and 500 metric tons by 2050. Currently, the only U.S.-licensed producer (Centrus) has delivered just 545 kilograms. DOE has allocated HALEU to five companies in 2025, but supply chain gaps remain a primary bottleneck.

Why is the Natrium reactor design ideal for powering data centers?

Data centers require consistent 24/7 baseload power, but AI workloads fluctuate. The Natrium reactor uniquely combines a 345MW sodium-cooled core with molten salt energy storage, allowing it to decouple power generation from the grid and ramp output from 345MW to 500MW on demand for up to five hours. This flexibility addresses the variable compute demands of AI inference workloads. Sodium-cooled fast reactors also operate at atmospheric pressure (unlike traditional high-pressure water reactors), reducing containment costs and improving safety margins.

How much power will data centers need by 2030?

According to the International Energy Agency, global data center electricity consumption is projected to more than double from 415 TWh in 2024 to 945 TWh by 2030—equivalent to Japan's entire electricity consumption. The IEA projects U.S. data center power demand will account for almost half of electricity demand growth through 2030. Gartner estimates AI-optimized servers will represent 44% of total data center power usage by 2030, up from 21% in 2025, with AI server electricity usage rising nearly fivefold from 93 TWh in 2025 to 432 TWh in 2030.

Which tech companies have signed nuclear deals for data centers?

Microsoft signed a 20-year PPA with Constellation to restart Three Mile Island Unit 1 (835MW) by 2027-2028, renamed Crane Clean Energy Center, backed by a $1 billion DOE loan guarantee. Google partnered with Kairos Power for 500MW of SMRs by 2035, with the first reactor by 2030, and signed a 50MW deal with TVA for the Hermes 2 plant. Amazon invested $500 million in X-energy for 5GW of capacity by 2039, plus signed a 1.9GW deal with Talen Energy through 2042. Meta secured Clinton Clean Energy Center output through 2047. Oracle announced plans for a 1GW data center powered by three SMRs.

What is NuScale's status as the only NRC-approved SMR?

NuScale remains the only SMR technology company with full NRC design approval. In May 2025, NRC approved NuScale's uprated 77MWe (250MWt) module design in under two years—ahead of schedule. This followed their original 50MWe design approval in 2020. NuScale is partnering with ENTRA1 Energy for deployment and remains on track for 2030 deployment, though they have not yet announced a binding customer deal. Their manufacturing partner Doosan has 12 modules in production at their South Korea foundry and could deliver up to 20 per year.

How many SMR license applications does the NRC expect?

According to NRC projections, the commission expects to receive 25 licensing applications for SMRs and advanced reactors in the next five years. Planned units will likely be up to 200MW in size. The ADVANCE Act (passed in 2024) has streamlined processes by reducing licensing fees by up to 50% and establishing a 25-month fast-track for license renewals. The NRC recently introduced Part 53, a technology-inclusive, risk-informed framework to help accelerate approvals while maintaining safety standards—though this regulation is still being finalized after industry feedback.

What role will microreactors play for defense and sovereign cloud applications?

Microreactors (under 20MW) may reach defense applications before commercial hyperscale deployments due to different regulatory pathways and national security priorities. According to defense industry analysis, the DoD's Defense Innovation Unit (DIU) launched ANPI with a goal of two microreactors operating on U.S. military bases by 2030. Project Pele's prototype mobile reactor is scheduled to be transported to Idaho National Laboratory in 2026. Radiant Industries expects to deliver a commercial 1.2MW Kaleidos microreactor system in 2028, designed to replace diesel generators at remote sites and small data centers.

Why do first-of-a-kind SMR costs remain so high?

Despite promises of factory-built economics, first-of-a-kind SMR costs have exploded to $14,600/kW—more than five times 2020 projections and 50% more per kilowatt than traditional reactors. Construction timelines are 7-10 years, not the advertised 2-4 years. Argentina's SMR is 600% over budget; China's and Russia's designs are years behind schedule; the U.S. NuScale UAMPS project collapsed under economics. Costs should decline after initial deployments prove the technology and supply chains mature—but the first reactors will be expensive.

What percentage of data center power could nuclear provide by 2035?

According to Deloitte analysis, nuclear energy could meet up to 10% of data center electricity demand by 2035. Currently, nuclear provides about 15% of the electricity consumed by data centers, with natural gas at 26%. As MIT Technology Review notes, to meet data center demand expected by 2030 with nuclear alone would require expanding the U.S. reactor fleet by 50%. The tech industry's nuclear deals represent long-term commitments into the 2040s, but the next-generation reactors being supported are modestly sized demonstrations—not yet at the scale needed to meet 2030 demand.

How does the ADVANCE Act change the SMR regulatory landscape?

The ADVANCE Act (2024) represents a fundamental policy shift ending decades of "nuclear winter" in the United States. Key provisions include: reducing advanced reactor licensing fees by up to 50%, instructing NRC to update environmental review processes, modernizing regulatory oversight, and developing protocols for siting reactors on industrial brownfield sites. According to federal analysis, President Trump's 2025 executive orders further aim to quadruple U.S. nuclear capacity to 400GW by 2050 (from 100GW currently) and require NRC to review new applications within 18 months.

What's the realistic investment thesis for nuclear and data centers?

The "Nuke Play" has fundamentally altered energy sector valuations. According to Wall Street analysis, Constellation Energy and Vistra have become top-performing utility stocks due to "behind-the-meter" deals with data centers at premium rates. Cameco benefits from uranium prices near 17-year highs. Centrus Energy remains the only U.S. company licensed to produce HALEU. The investment thesis: nuclear is no longer "legacy" infrastructure but the essential backbone of the AI economy. However, expect market consolidation as "winners" with operational reactors and secured fuel separate from "pre-revenue" SMR startups. The "easy money" from initial hype has been made—long-term structural demand remains.

Glossary: Nuclear SMR & Data Center Power Terms

HALEU (High-Assay Low-Enriched Uranium) — Nuclear fuel enriched between 5-20% U-235, compared to 3-5% for conventional reactor fuel. Required by most Gen IV SMR designs. Current U.S. production: ~900 kg/year. Projected demand by 2035: 50+ metric tons/year.

Thermal Creep — The gradual deformation of metal under sustained stress at high temperatures (700°C-950°C). Gen IV reactors operate where materials stretch over time. ASME Section III Division 5 requires ~10 years of testing data to certify materials for 30-year life. Cannot be accelerated.

SMR (Small Modular Reactor) — Nuclear reactors under 300MW designed for factory fabrication and modular deployment. Key vendors: NuScale (only NRC-approved), TerraPower (Natrium), Kairos Power, X-energy.

Gen IV Reactor — Fourth-generation designs operating at 700°C-950°C using molten salt, liquid sodium, or helium coolants. Higher efficiency and passive safety vs. current Light Water Reactors.

FOAK (First-of-a-Kind) — Initial commercial deployment of a new reactor design. Current SMR FOAK costs: $14,600/kW (vs. $2,800/kW projections). Timelines: 7-10 years (vs. advertised 2-4 years). Costs typically decline 30-50% for subsequent units.

Bridge Strategy — Tactical approach for the 2025-2035 gap: (1) Deploy natural gas + batteries now, (2) Design nuclear-ready infrastructure (switchgear, seismic isolation) for seamless SMR transition.

LWR (Light Water Reactor) — Dominant global nuclear technology using water as coolant/moderator. Operates at high pressure (~150 atmospheres) but lower temperatures than Gen IV. 50+ years of operational data.

In-Pile Testing — Physical testing inside an operating reactor to validate material performance under radiation. Required by NRC because simulations only damage surface microns; neutrons penetrate entire vessel depth.

Related Reading from The Control Room

The SMR Market Correction: Why AI Infrastructure Requires a Gas-to-Nuclear Bridge — The tactical playbook for surviving until SMRs arrive.

AI Training vs. Inference: The $300B Shift Everyone is Missing — Why the real power demand is in inference, not training.

Is AI Infrastructure Overbuilt? — An operator's view on the $100B gamble.

From Parameters to Physics: Why Watts per Token is the Only Metric for Industrial AI — The compute reckoning ahead.

Sources

Utility Dive: NRC Advanced Reactor Licensing Roadmap — TerraPower Natrium groundbreaking and licensing timeline

WWT: Big Tech's Nuclear Bet on SMRs — HALEU bottlenecks and timeline analysis

Data Center Frontier: Google and Amazon SMR Investments — Hyperscaler nuclear strategy details

DOE: HALEU Availability Program — Fuel supply chain status

IEA: AI and Data Center Electricity Demand — 945 TWh projection by 2030

Gartner: Data Center Electricity Demand — AI server power growth projections

NuScale Power: NRC Design Approval — Only NRC-approved SMR technology

Canary Media: Google Kairos Power Deal — 500MW deployment timeline

ASME Section III, Division 5 — High-temperature reactor materials certification requirements

NRC: Part 53 Advanced Reactor Framework — New licensing pathway for advanced reactors

Rare Earth Exchanges: SMR Cost Analysis — First-of-a-kind SMR costs at $14,600/kW

Trellis: Amazon, Google, Meta, Microsoft Go Nuclear — Hyperscaler nuclear deal overview

MIT Technology Review: AI Nuclear Power — Nuclear capacity expansion requirements

Utility Dive: NRC Licensing Rules for Advanced Reactors — ADVANCE Act implications

TerraPower: Natrium Technology — Sodium-cooled fast reactor design

Centrus Energy: HALEU Production — Only U.S.-licensed HALEU producer

____________________________________

Tony Grayson is a recognized Top 10 Data Center Influencer, a successful entrepreneur, and the President & General Manager of Northstar Enterprise + Defense.

A former U.S. Navy Submarine Commander and recipient of the prestigious VADM Stockdale Award, Tony is a leading authority on the convergence of nuclear energy, AI infrastructure, and national defense. His career is defined by building at scale: he led global infrastructure strategy as a Senior Vice President for AWS, Meta, and Oracle before founding and selling a top-10 modular data center company.

Today, he leads strategy and execution for critical defense programs and AI infrastructure, building AI factories and cloud regions that survive contact with reality.

Comments